Milk Protein Market Is Encouraged to Reach USD 8 Billion by 2033 at a CAGR of 5.9%

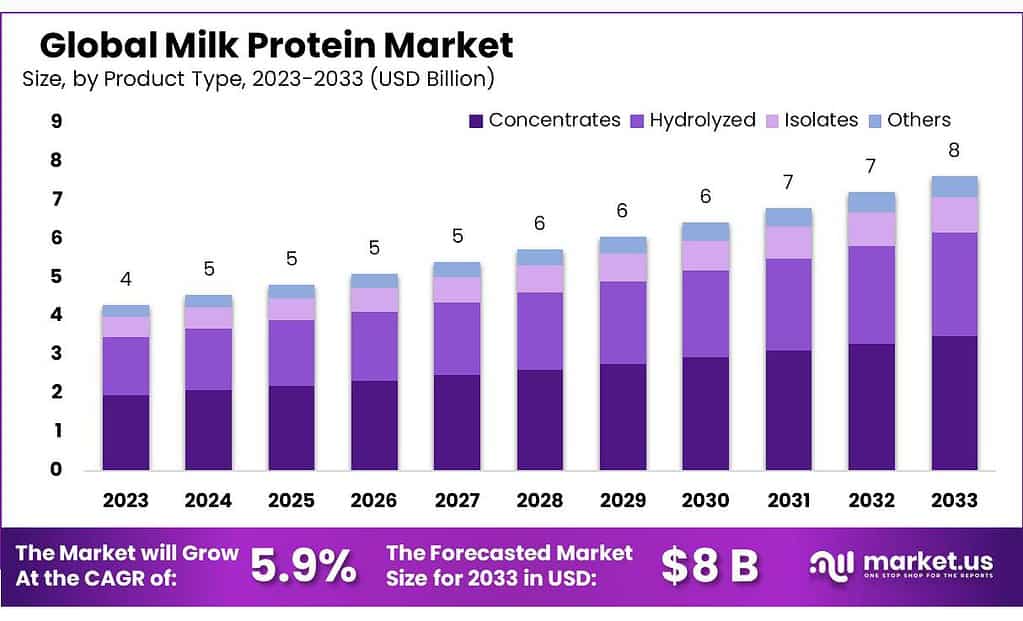

According to Market.us, the Milk Protein Market size is projected to surpass around USD 8 billion by 2033, from USD 4 billion in 2023, and it is poised to reach a registered CAGR of 5.9% from 2023 to 2033.

The Milk Protein Market refers to the sector of the global economy that deals with the production, distribution, and sale of proteins derived from milk. These proteins, primarily casein, and whey, are extracted from milk and utilized for their nutritional and functional properties in various products.

Milk proteins are highly valued for their high-quality amino acid profiles, making them essential for muscle repair, growth, and overall health. They are widely used in nutritional supplements, sports nutrition products, infant formulas, and functional foods and beverages. The market also caters to the food processing industry, where milk proteins are used to enhance the texture, flavor, and nutritional value of products such as cheeses, yogurts, and baked goods.

The growth of the Milk Protein Market is driven by increasing consumer awareness of health and nutrition, rising demand for protein-enriched diet options, and innovations in food technology. Additionally, the versatility of milk proteins in applications ranging from dietary supplements to functional foods continues to expand the market’s reach and potential.

Gain insights into pivotal market trends, drivers, and challenges with our PDF sample report: https://market.us/report/milk-protein-market/#requestSample

Key Takeaway:

- Market Projection: Milk Protein Market to hit USD 8 billion by 2033, with a 5.9% CAGR from 2023.

- Product Type Dominance: Concentrates lead with 45.8% market share in 2023, followed by hydrolyzed and isolates.

- Form Preference: Powdered milk proteins dominate at 50.5% in 2023, valued for convenience and versatility.

- Application Usage: Dairy products top application at 48.9% in 2023, enhancing texture and nutritional value.

- End-use Utilization: Food & beverages lead at 41.8% in 2023, followed by nutraceuticals & dietary supplements.

- Regional Insights: Asia Pacific leads with 45% market share, driven by health trends and technological advancements.

Market Leading Segmentation

By Product Type

- Concentrates: Held over 45.8% market share in 2023, valued for balanced nutrition and versatility.

- Hydrolyzed Proteins: Significant segment for enhanced digestibility, favored in infant formulas and clinical nutrition.

- Isolates: A specialized segment providing high protein content with low fat and lactose, popular in sports nutrition.

By Form

- Powder: Dominated with over 50.5% market share in 2023, prized for convenience and versatility.

- Liquid: Follows for ready-to-use convenience, primarily in beverage applications.

- Paste/Spreadable: Less common but offers unique options, such as protein-enriched spreads.

By Application

- Dairy Products: Led with over 48.9% market share in 2023, vital for texture and nutritional enhancement.

- Infant Formula: Significant for nutrient composition similarity to human milk, crucial for infant growth.

- Dietary Supplements: Popular among athletes and fitness enthusiasts for muscle repair and growth support.

By End-use

- Food & Beverages: Dominated with over 41.8% market share in 2023, enhancing texture and nutritional value.

- Nutraceuticals & Dietary Supplements: Integral for high biological value and muscle support.

- Pharmaceuticals: Utilized for bioactive properties in medical nutrition products, aiding in recovery.

- Cosmetics and Personal Care: Emerging segment utilizing hydrating and film-forming abilities.

- Pet Care Industry: Utilizes milk proteins for nutritional content, especially in formulations for growth.

Get quick access to our premium research report: https://market.us/purchase-report/?report_id=14200

By Product Type

- Concentrates

- Hydrolyzed

- Isolates

- Others

By Form

- Powder

- Liquid

- Paste/Spreadable

- Others

By Application

- Dairy Products

- Infant Formula

- Dietary Supplements

- Others

By End-use

- Food & Beverages

- Nutraceuticals & Dietary Supplements

- Pharmaceutical

- Cosmetics & Personal Care

- Pet Care Industry

- Others

Market Key Players

- Amco Protein

- Arla Foods

- Fonterra Co-operative Group Limited

- Frieslandcampina

- Glanbia PLC

- Groupe Lactalis S.A.

- Havero Hoogwewt

- Hoogwegt Groep B.V.

- Kerry Group plc

- Koninklijke FrieslandCampina N.V.

- Lactalis

- Sachsenmilch Leppersdorf GmbH

- Saputo Inc.

Regional Analysis

Asia Pacific is set to lead the global milk protein market, capturing a significant 45% share. This growth is fueled by rising consumer awareness of health and wellness, particularly in sectors like sports nutrition, functional foods, and infant nutrition. Substantial investments in food technology and dairy development in countries like China, India, and Southeast Asian nations are expected to drive market expansion, supported by strong agricultural capabilities and a focus on innovative dairy products.

Unlock competitive advantages with our PDF sample report, detailing market trends, drivers, and challenges: https://market.us/report/milk-protein-market/#requestSample

Major Driver: Increasing Health Consciousness and Demand for Functional Foods

A significant driver propelling the milk protein market is the increasing health consciousness among consumers and the growing demand for functional foods. With rising awareness of the importance of nutrition in overall health and wellness, consumers are seeking products that offer added health benefits, including milk proteins. Milk proteins are recognized for their high nutritional value, containing essential amino acids and bioactive peptides that support muscle growth, weight management, and overall well-being.

Additionally, the popularity of functional foods, which are fortified with nutrients like milk proteins to provide specific health benefits, further drives market growth. As consumers prioritize healthier dietary choices and seek convenient options to meet their nutritional needs, the demand for milk proteins in various food and beverage applications continues to rise. This trend is expected to fuel market expansion as manufacturers innovate and introduce new products tailored to meet the evolving preferences of health-conscious consumers.

Major Restraint: Allergies and Intolerances

A significant restraint facing the milk protein market is the prevalence of allergies and intolerances among certain consumer segments. Milk allergy, which is one of the most common food allergies worldwide, affects individuals who are unable to tolerate proteins found in cow’s milk. Additionally, lactose intolerance, which affects individuals who have difficulty digesting lactose, a sugar found in milk, poses a challenge for some consumers. These allergies and intolerances limit the consumption of milk proteins and dairy products, reducing market potential among affected populations.

Furthermore, concerns about allergenicity and intolerance may deter some consumers from purchasing products containing milk proteins, impacting market growth. Manufacturers must address these challenges by developing alternative protein sources and offering allergen-free options to cater to the needs of consumers with specific dietary restrictions. Overcoming these restraints requires targeted marketing strategies and product innovations to ensure inclusivity and accessibility in the milk protein market.

Major Opportunity: Rising Demand for Plant-Based Alternatives

An exceptional opportunity for the milk protein market lies in the rising demand for plant-based alternatives. While traditional milk proteins are derived from animal sources like cow’s milk, there is a growing trend towards plant-based diets driven by health, environmental, and ethical concerns. As consumers seek alternatives to animal-derived products, plant-based milk proteins, such as those derived from soy, pea, almond, and hemp, are gaining popularity. These plant-based alternatives offer similar nutritional profiles to traditional milk proteins, including essential amino acids and vitamins, while also appealing to vegan and lactose-intolerant consumers.

Additionally, plant-based milk proteins are often perceived as more sustainable and environmentally friendly than animal-derived counterparts, further driving demand among eco-conscious consumers. Manufacturers have the opportunity to capitalize on this trend by expanding their product portfolios to include plant-based milk proteins and developing innovative formulations to meet the diverse preferences of health-conscious consumers.

Major Trend: Clean Label and Sustainable Sourcing

A significant trend shaping the milk protein market is the increasing emphasis on clean label and sustainable sourcing practices. Consumers are becoming more discerning about the products they consume, seeking natural, minimally processed ingredients with transparent sourcing and production methods. In response, manufacturers are prioritizing clean label formulations, using milk proteins sourced from ethically and sustainably managed farms. Additionally, there is a growing demand for organic and non-GMO milk proteins, reflecting consumer preferences for natural and environmentally friendly products.

Furthermore, initiatives to reduce carbon footprint and promote animal welfare in dairy farming contribute to the trend towards sustainable sourcing of milk proteins. As consumers become more informed and conscientious about their purchasing decisions, clean labels and sustainable sourcing practices are becoming integral to brand identity and market success in the milk protein industry. Manufacturers that embrace these trends and align their products with consumer values are well-positioned to capitalize on the growing demand for clean, sustainable, and ethically sourced milk proteins.

Get in Touch with Us:

Global Business Development Team – Market.us

Market.us (Powered By Prudour Pvt. Ltd.)

Address: 420 Lexington Avenue, Suite 300,

New York City, NY 10170, United States

Tel: +1 718 618 4351

Email: inquiry@market.us

Explore More Chemical Market Research Reports

Editor Details

-

Company:

- Wired Release

- Website: