Wearable Payment Devices Market to grow by USD 225 Billion, Globally at 16.7% CAGR

Introduction

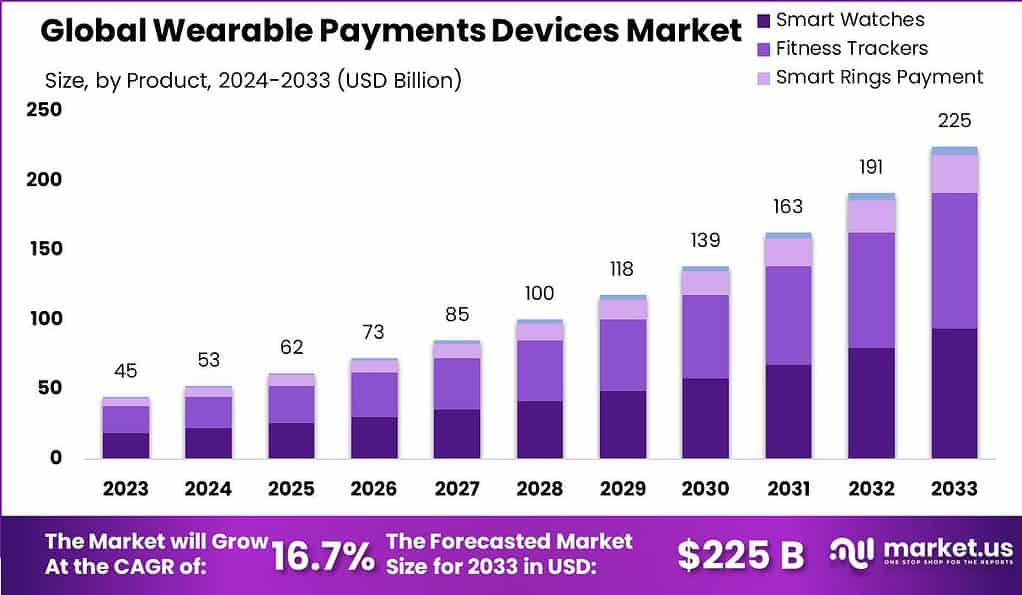

The global Wearable Payment Devices Market is poised for substantial growth, estimated to reach a value of USD 225 billion by 2033, driven by a robust CAGR of 16.7% from 2024 to 2033. These devices, including smartwatches, fitness trackers, and payment wristbands, facilitate contactless transactions using technologies like Near Field Communication (NFC), QR codes, and barcodes. The market has experienced significant expansion due to the increasing popularity of wearable technology and the rising adoption of contactless payment systems, offering users convenience and security.

One significant trend is the dominance of fitness trackers in the market, holding over 43.6% share in 2023. These devices have evolved to integrate payment functionalities alongside health monitoring features, catering to health-conscious consumers seeking seamless payment solutions. QR codes and barcodes have also emerged as leading technologies, capturing more than 36.2% market share in 2023 due to their accessibility and universal applicability in payment transactions.

Key drivers of market growth include the increased adoption of contactless payments, aligning with consumer preferences for hygienic and convenient transactions. However, challenges such as battery drain issues and security concerns pose restraints to market expansion. Battery efficiency and robust security measures are crucial for addressing these challenges and maintaining consumer trust.

Enhance Your Understanding with Complete Methodology – Get the Report Now!

Wearable Payment Devices Statistics

- Market Growth Projection: The Wearable Payment Devices Market is anticipated to achieve a substantial milestone, reaching an estimated worth of USD 225 billion by 2033, reflecting a robust Compound Annual Growth Rate (CAGR) of 16.7% throughout the forecast period.

- Device Type Dominance: In 2023, the Fitness Trackers segment held a dominant market position within the Wearable Payment devices market, capturing more than a 43.6% share, indicating the strong preference for wearable devices that blend health monitoring with convenient payment solutions.

- Technology Leadership: The Quick Response (QR) & Barcodes segment led the Wearable Payment devices market in 2023, holding over a 36.2% share. This dominance is attributed to the universal applicability and ease of use associated with QR codes and barcodes, facilitating widespread adoption among consumers and merchants.

- Application Focus: The Retail & Grocery Stores segment emerged as the dominant market segment within the Wearable Payment devices market in 2023, accounting for over a 31.4% share. This prominence underscores the importance of convenience and speed in retail transactions, aligning with consumers’ preference for contactless and cashless payment methods.

- Regional Market Dynamics: Europe stood out as the leading market region for Wearable Payment devices in 2023, capturing more than a 30.7% share. This leadership position is attributed to Europe’s strong financial infrastructure, high consumer adoption of digital payment methods, and supportive regulatory environment.

- Prominent players such as Garmin Ltd., Barclays, Samsung Electronics Co Ltd, Xiaomi Corporation, Visa, Google LLC, Mastercard Inc., and Apple Inc. have significantly shaped the market landscape through strategic innovations and acquisitions, driving market growth and competition. Recent developments include Samsung’s acquisition of LoopPay and Xiaomi’s launch of the Redmi Watch 3 Pro with NFC support for contactless payments, showcasing continued efforts to enhance wearable payment capabilities and expand market presence.

Factors affecting the growth of the Wearable Payment Devices Market

- Technological Advancements: The continuous improvement in technology is a primary driver for the wearable payment devices market. Innovations such as NFC (Near Field Communication), RFID (Radio Frequency Identification), and biometric technology have made wearable payment devices not only more secure but also more convenient to use. As these technologies improve, wearable devices become faster and more user-friendly, enhancing the overall consumer experience.

- Consumer Adoption: The willingness of consumers to adopt new technology significantly impacts the growth of this market. The increasing demand for convenience and speed in transactions drives consumer interest in wearable payment devices. As people become more accustomed to cashless and cardless payment methods, the shift towards wearable payment devices becomes more pronounced.

- Financial Infrastructure: The development and availability of supporting financial infrastructure are crucial for the adoption of wearable payment devices. This includes the widespread availability of point-of-sale systems capable of accepting payments from wearable devices and the integration of these systems with major payment networks. Markets with advanced payment infrastructure are likely to see quicker adoption rates.

- Regulatory Environment: The regulatory framework governing electronic payments also affects the growth of wearable payment devices. Regulations that ensure the security and privacy of electronic transactions can boost consumer confidence, while overly stringent regulations may slow down market growth by placing burdens on manufacturers and consumers.

- Economic Factors: Economic conditions play a role as well. In regions with higher disposable incomes, consumers are more likely to invest in new technologies, including wearable payment devices. Conversely, in areas with economic constraints, growth may be slower due to limited consumer spending on non-essential goods.

- Partnerships and Collaborations: Strategic partnerships between technology providers, financial institutions, and retailers are vital for promoting the integration and acceptance of wearable payment technologies. These collaborations help expand the market reach and provide users with seamless payment experiences across different platforms and locations.

Plan your Next Best Move. Purchase the Report for Data-driven Insights: https://market.us/purchase-report/?report_id=115523

Device Type Analysis

In 2023, fitness trackers stood out in the wearable payment devices market, commanding a significant market share of 43.6%. This dominance is primarily due to the dual functionality these devices offer. Consumers appreciate the ability to monitor health and fitness metrics while seamlessly conducting transactions. The convenience of integrating payment technology into fitness trackers has encouraged their widespread adoption, particularly among health-conscious consumers who value efficiency in their wearable technology.

Technology Analysis

The Quick Response (QR) & Barcodes technology held a dominant position in the wearable payment devices market in 2023, with a notable market share of 36.2%. This technology’s widespread adoption can be attributed to its ease of use and the minimal technological infrastructure required for implementation. Retailers favor QR & Barcodes because they can be easily integrated into existing systems without substantial investments. Additionally, consumers find QR and barcode scanning a straightforward and secure method to make payments, enhancing their shopping experience.

Application Analysis

In the retail and grocery stores segment, there was a significant adoption of wearable payment devices, capturing a market share of 31.4% in 2023. This prevalence is due to the high transaction volume in these settings, where speed and convenience are critical. Wearable payment devices streamline the purchasing process, allowing for faster checkout times and improved customer satisfaction. Their ability to enhance the shopping experience by reducing wait times and simplifying transactions has made them particularly popular in busy retail environments.

Market Dynamics

Driver: Convenience and Efficiency

The primary driver for the growth of the wearable payment devices market is the convenience and efficiency these devices offer. Wearable payment devices, such as smartwatches and fitness bands, enable users to make transactions quickly without the need to carry cash or cards. This functionality is particularly appealing in today’s fast-paced world where consumers value speed and ease in their transactions. Additionally, these devices often come equipped with near-field communication (NFC) technology, allowing for contactless payments that can be processed in seconds. This seamless integration of payment technology into everyday wearables greatly enhances the user experience, encouraging more consumers to adopt this technology.

Restraint: Security Concerns

One significant restraint in the wearable payment devices market is the concern over data security and privacy. As these devices process sensitive financial information, they are potential targets for cyber-attacks. Consumers may be hesitant to adopt wearable payment technologies due to fears that their financial data could be compromised or misused. Furthermore, the technology’s reliance on wireless communication raises concerns about the interception of data during transactions. Manufacturers must address these security issues through robust encryption methods and secure data handling practices to reassure consumers and encourage broader adoption.

Opportunity: Integration with Cryptocurrencies and Loyalty Programs

A promising opportunity in the wearable payment devices market is the integration of these devices with cryptocurrencies and loyalty programs. As cryptocurrencies continue to gain acceptance, wearable devices that offer crypto-payment options could attract a niche market of tech-savvy and privacy-conscious users. Additionally, integrating loyalty and rewards programs directly into wearable devices can enhance customer retention and increase usage rates. This could provide users with a more personalized shopping experience and allow businesses to gather valuable data on consumer spending habits, further driving market growth.

Challenge: Technological Compatibility and User Interface Design

A major challenge facing the wearable payment devices market is ensuring technological compatibility and user-friendly interface design. Wearable devices must be compatible with a wide range of payment systems and financial institutions to be practical for everyday use. Additionally, the small size of wearable devices can limit the user interface design, making it difficult to provide a seamless and intuitive user experience. Addressing these design and compatibility issues is crucial for manufacturers to ensure the devices meet consumer expectations and function effectively across various platforms and technologies.

Request for Research Methodology to Understand Our Data-sourcing Process in Detail: https://market.us/report/wearable-payments-devices-market/request-sample/

Key Market Segments

By Device Type

- Smart Watches

- Fitness Trackers

- Smart Rings

- Payment Wristbands

By Technology

- Near Field Communication Technology

- Quick Response & Barcodes

- Radiofrequency Identification

By Application

- Retail & Grocery Stores

- Restaurants & Bars

- Entertainment Sources

- Hospital & Pharmacies

Top Market Leaders

- Garmin Ltd.

- Barclays

- Samsung Electronics Co Ltd

- Xiaomi Corporation

- Visa

- Google LLC

- Mastercard Inc.

- Apple Inc

- Other Key Players

Recent Developments

- Samsung Electronics Co Ltd: In February 2023, Samsung Electronics Co Ltd acquired LoopPay, a mobile payments technology company, aiming to enhance its wearable payment capabilities. This strategic move reinforces Samsung’s position in the market and signals potential developments in innovative wearable payment solutions.

- Xiaomi Corporation: In October 2023, Xiaomi Corporation launched the Redmi Watch 3 Pro, a new smartwatch equipped with NFC support for contactless payments. This product launch demonstrates Xiaomi’s ongoing commitment to expanding its presence in the Wearable Payment market, particularly in the affordable segment, catering to a broader consumer base.

Contact Data

Global Business Development Teams – Market.us

Market.us (Powered By Prudour Pvt. Ltd.)

Email: inquiry@market.us

Address: 420 Lexington Avenue, Suite 300 New York City, NY 10170, United States

Tel: +1 718 618 4351

Website: https://market.us/

Explore More Reports

- AI in Education Market is estimated to reach USD 73.3 billion by 2033, Riding on a Strong 35.10% CAGR throughout the forecast period.

- AI In Fintech Market is estimated to reach USD 76.2 billion by 2033, Riding on a Strong 20.5% CAGR throughout the forecast period.

- AI in Retail Market is estimated to reach USD 127.2 billion by 2033, Riding on a Strong 29.9% CAGR throughout the forecast period.

- Predictive AI In Media And Entertainment Market is estimated to reach USD 4.7 billion by 2033, Riding on a Strong 12.0% CAGR.

- The Explainable AI Market size is expected to be worth around USD 34.6 Billion by 2033, from USD 6.4 Billion in 2023, growing at a CAGR of 18.4% during the forecast period from 2024 to 2033.

- AI In Marketing Market is estimated to reach USD 214 billion by 2033, Riding on a Strong 26.77% CAGR throughout the forecast period.

Editor Details

-

Company:

- Wired Release

- Website: